TD Bank is one of the biggest institutions within Canada by market capitalization and assets and is regarded as one of Canada’s top six banks. This is what makes TD an exemplary bank in Canadian Chartered Banks. TD operates across Canada as well as across all of the East Coast of the United States as well as an international presence. As of July 20, 2021, TD Bank is the third largest corporation within Canada and its total market value exceeding 150 billion dollars. In actuality, TD Bank is the 12th largest bank in the world, and one of the top 10 banks within the USA. TD offers a broad range of services for its vast customer base, which includes commercial banking, retail banking capital market services and insurance. With more than 1200 branches with 89,000 staff, TD serves over 9 million customers.

Brampton Mortgage Options

Brampton Fixed-Rate Mortgages

Secure yourself knowing that the interest rate you pay won’t rise during the time period you choose.

Fixed rate mortgages provide security, and along in turn security. After you’ve chosen your period, you’ll be able to rest assured that your interest rate won’t fluctuate for the time period you choose.

You can select the length of 6 months 1, 2 3, 4, 5 6, 7, or 10 years.

Payment Options:

Regular payments are able to be increased 100 percent over the course of the contract at no cost every calendar year.

You can prepay at least 15% of the principal amount of your mortgage at least once per year, at no cost.

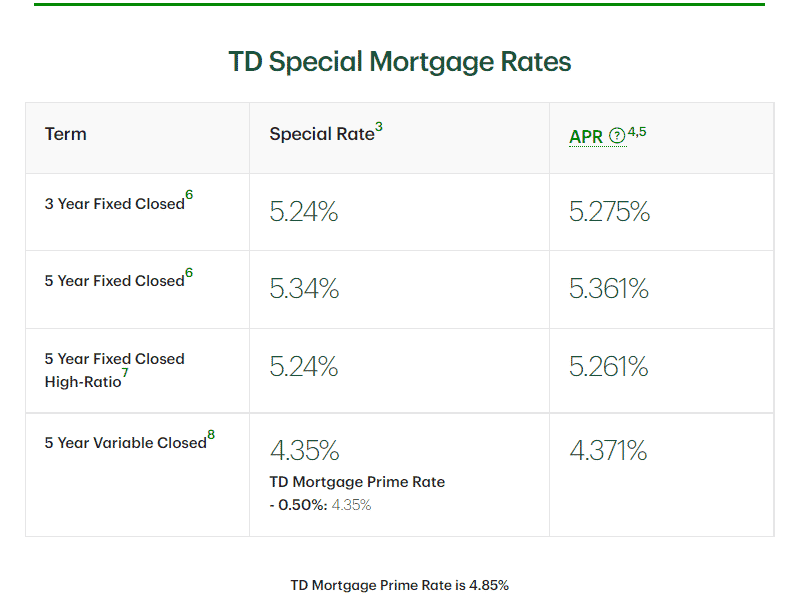

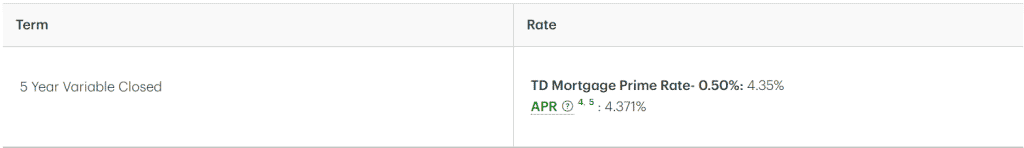

TD Bank Variable Mortgage Rates in Brampton

The TD Bank variable rate mortgage offers fixed monthly installments over the duration of your mortgage but the interest rate is subject to fluctuation depending on changes to the TD Bank’s main rate. If TD’s prime rate moves lower the amount you pay will go to interest while a greater portion of it will be put towards the payment of the principal. If the rate at which TD’s prime rate is higher and your monthly payment increases, more will be directed towards interest and less towards your principal mortgage. This is a good investment tool for people who expect that interest rates within Canada to decrease in the coming years. Another option is a convertible mortgage. This is an fixed rate or variable mortgage that permits the possibility of converting to an interest-only mortgage anytime.

How do I consider comparing interest rates on mortgages?

Making a decision on to take out a mortgage is an important financial decision because it requires borrowing a substantial quantity of funds. The interest rate on mortgages can be one of many variables which affect the total amount you be required to pay in the course of the amortization time. This means that you can save money by locating the lowest interest rate. Alongside the rate of your mortgage it is also important to compare the conditions and terms of each mortgage to ensure that you find the best one for your needs.

How much could I save by comparison of mortgage interest rates in Brampton, Canada?

Due to the large amount of money loaned under a mortgage even the slightest change in the interest rate of a mortgage could result in you saving money throughout the mortgage term, or even more in the course of an amortization time. Although the rate of your mortgage is an important aspect to consider but you should make sure you look over the terms and conditions of every kind of mortgage to be sure you pick the appropriate one for your needs.

What’s the main difference between a fixed and variable interest rate in TD?

Fixed interest rates is your rate of interest, in addition to the principal and interest payment will remain exactly the same throughout the mortgage time. With a variable rate your interest rate could fluctuate depending on changes in the T.D. Mortgage Prim Rate. Although your monthly payments will stay the same, the amount from each payment which will go towards principal and interest may differ. It is important to take a close review of the distinctions between variable and fixed interest rates before making the decision.