What Every Canadian Homeowner Needs to Know

Anyone involved in the real estate industry knows that establishing the accurate market value of a home is of paramount importance, especially in such important junctures as selling, and mortgage financing among others. Home evaluation involve an assessment of your home market value using several factors that inform your decision to sell the property. To some Canadian homeowners, this process might sound a bit overwhelming, but with the right help and direction, it’s a great tool in your toolbox when it comes to real estate. Team Arora – the team of professionals with extensive experience and the company’s commitment to the customers’ needs is ready to guide you through this crucial stage.

Why Home Evaluations Matter

Accurate Pricing: It enables one to set a correct market price whether one is in a position to sell or to buy.

Negotiation Power: Having a better estimate makes a position in a negotiation stronger.

Market Visibility: Affordable homes have more prospective buyers than those that are overpriced, which must be sold faster.

And knowing these benefits, it is easy to see that home evaluation are not simply about crunching the numbers, they are concepts rooted in strategy and expertise.

The Home Evaluation Process

- Initial Consultation

The process starts with an initial consultation where Team Arora professionals ascertain your objectives and acquire basic data about the property.

- Property Inspection

There is then a physical assessment of the property based on factors such as location, size, physical state, and any peculiarities.

- Market Analysis

The appraisal entails a competitive analysis of your property against those of similar establishments in the market.

- Final Report

A comprehensive report is generated where the value of your home in the market as well as the reasoning behind such assessment is provided.

Planning for Your Home Appraisal

Gather Documents: Bring records such as title deeds, tax receipts, and any previous appraisal reports if any.

Home Improvements: State any changes which have been made to the property, including any renovation or upgrade.

Clean and Declutter: Offering a tidy and neat house can help him in the evaluation in a positive way.

Expertise of Team Arora

Most importantly, the team carrying out the home evaluation defines the overall success of this process. Peculiarities This team is especially valuable due to its expertise and dedication to achieving top results.

Please go to the Team Arora section to get acquainted with the people who will be there to help you during your real estate experience.

Parveen Arora, Team Lead (Broker of Record)

Parveen, a professional real estate agent who has more than 20 years in this sector is in charge of the team and has adequate knowledge of current trends. With his valuable experience and profound understanding of the strategies, he has been able to assist numerous clients in accomplishing their real estate objectives.

Priya Bajaj is the Senior Real Estate Advisor (Broker / Team Lead)

Priya specializes in markets and clients along with conducting market research. Her efficiency when it comes to analyzing the needs of the client and identifying the properties that would suit them best is essential for the successful work of the team.

Sam Dhillon, Marketing Specialist (Broker / Team Manager)

Through the innovative ways Sam uses to market the properties, every property is given the optimum exposure. His expertise in digital marketing and social media to spin demand to get the attention of potential clients.

Dinesh Arora holds the position of Client Relations Manager (Sales Representative / Team Lead)

Dinesh is the go-between for the team and the clients. The skills and experience of this employee are matched by his interpersonal skills and his commitment to fulfilling customers’ needs and expectations.

The Benefits of Joining Team Arora

Comprehensive Market Knowledge: They also help in providing realistic and accurate assessments of the market since the team understands the market exceptionally well.

Personalized Service: It has been noted that each client pays individual attention and gets specific solutions.

Proven Track Record: Over the years, Team Arora has been awarded and recognized for its excellent performance in hair transplant surgery.

Innovative Marketing: Marketing your property through innovative marketing, Team Arora will ensure that your property gets the attention it deserves.

Common Pitfalls to Avoid When Considering the Value of a Home

Avoid these pitfalls, and your evaluation should go fairly smoothly:

- Ignoring the Small Repairs: Little issues can become big and begin to reduce the value of your home.

- Overestimation: Overpricing can set the property up for disappointment because of long days on the market.

- Neglect Market Trends: Being aware of the prevailing market condition is of utmost importance for a proper valuation.

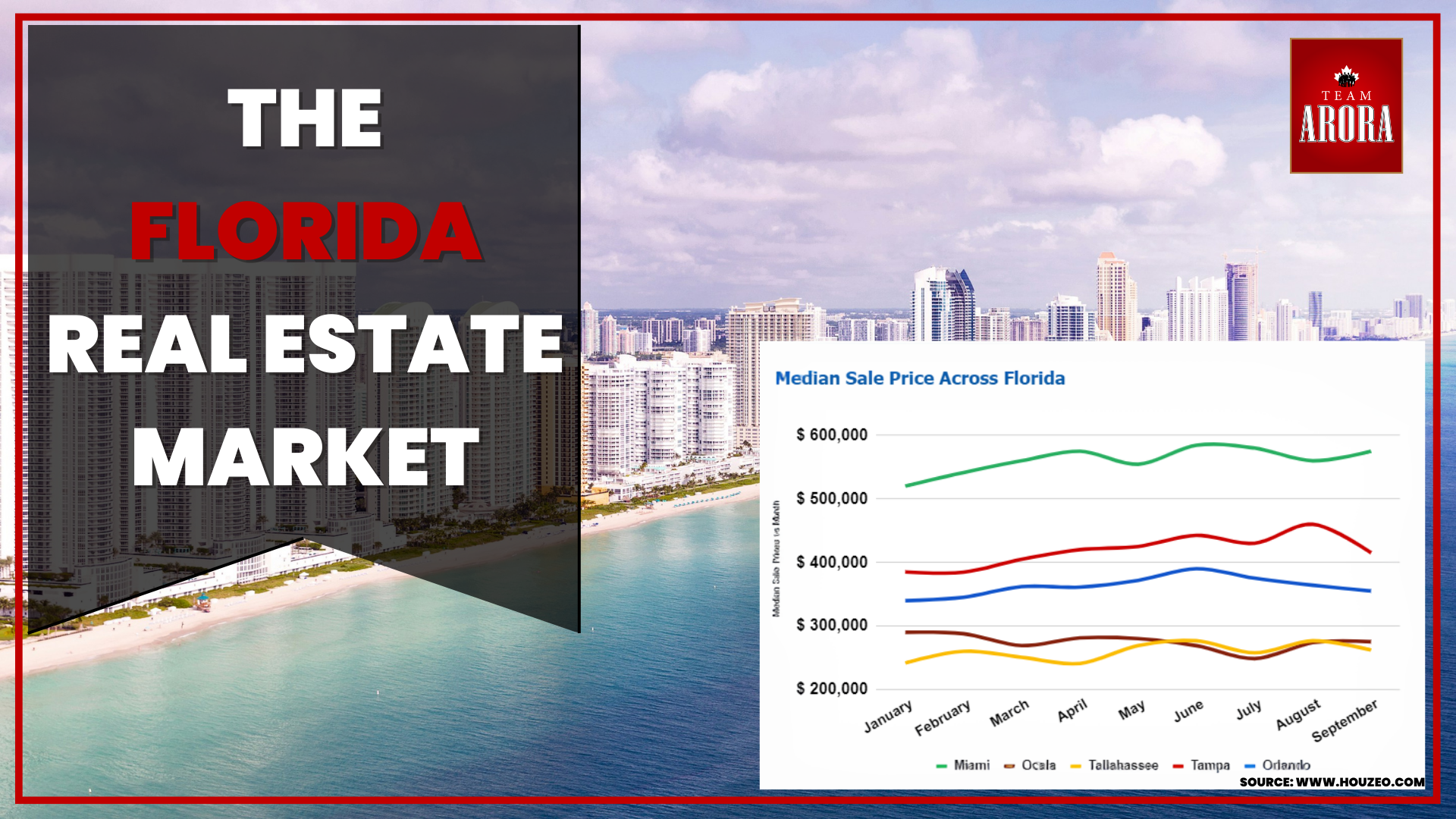

How Market Trends Can Impact Your Home Valuation

Market trends play a huge role in determining the value of your home. For example, in a seller’s market, prices are generally driven upwards by a surplus in demand relative to supply. On the other hand, in a buyer’s market, where there’s more property on the market than buyers buy, prices can be pushed lower. Being apprised of these trends sets realistic expectations and strategic pricing.

The Importance of Home Improvements in Raising the Value Of Your Home

Investing in these steps toward home improvement can be a material add-on to the value of our homes. The important areas to focus on are:

Kitchen and Bathrooms- Renovating such rooms usually bring significant returns.

Energy Efficiency: Refinements to lower energy operating costs are attractive to buyers.

Curb Appeal: First impressions mean a lot in the world of real estate. Improvements to your home’s exterior can increase your home’s marketability.

That’s why an accurate home valuation is of such importance in the competitive Canadian real estate market, offering rare insights for the one who wants to be equipped with information to make informed decisions, be it buying or selling or simply being curious about how much his property is worth. Team Arora provides you with our expert and personalized service, ensuring that you get the most accurate and favourable evaluation possible. Don’t leave your real estate decisions to chance. Contact Team Arora today to book an appointment to find out the actual value of your property through a professional home evaluation. Allow us to provide you with confidence and success in your job through navigating real estate.