When it comes to selling a home, many people wait for the traditionally busy spring or summer markets. However, the holiday season can be an unexpectedly advantageous time to list your property. While it may seem counterintuitive, selling during this time can offer unique opportunities that might not be as readily available at other times of the year. Here’s why putting your home on the market during the holidays could be a smart move.

1. Motivated Buyers Mean Serious Offers

Unlike the casual shoppers of the peak months, holiday buyers often have pressing reasons for moving, such as job relocations, end-of-year tax benefits, or changes in family dynamics. This urgency can lead to quicker offers and smoother negotiations.

Additionally, many buyers want to close before the new year, which can translate into a faster sales process. If you’re looking for a swift transaction, listing your home during the holiday season can be a strategic advantage.

2. Less Competition Among Sellers

While most sellers wait until spring or summer, listing your home during the holidays means there is less competition in the market. Fewer homes available for sale can work in your favor, as buyers have fewer options and are more likely to consider your property seriously. This limited inventory can help your home stand out, making it easier to attract attention from motivated buyers.

Lower competition also often leads to better offers. In a less crowded market, buyers may feel they need to make competitive bids to secure a home they’re interested in, which can result in offers closer to your asking price or even above it.

3. Festive Décor Adds Appeal

The holidays are a time when homes are decorated with warmth and charm, creating a welcoming and cozy atmosphere that can appeal to buyers on an emotional level. Well-placed holiday decorations can make your home feel inviting and highlight its best features. Twinkling lights, a festive wreath, or tasteful table settings can create a vision of what it would be like for buyers to celebrate their own holidays in the space.

However, it’s essential to keep holiday décor subtle and neutral. Avoid over-the-top decorations that could distract from the home’s actual features or make spaces feel smaller.

4. Financial Motivations for Buyers

The end of the year often brings financial incentives for buyers. Some people are eager to make purchases before December 31st to take advantage of tax deductions related to mortgage interest or property taxes. Additionally, buyers may receive annual bonuses or are looking to invest their savings in a home purchase before year-end financial deadlines.

This can mean that buyers are more willing to make decisions quickly and may even be prepared to make more competitive offers to secure a deal before the holidays are over. This sense of urgency can be a major plus for sellers who want a fast transaction with favorable terms.

5. A Unique Opportunity to Market Your Home

The holidays give you a chance to market your home in a way that isn’t possible at other times of the year. The seasonal atmosphere allows you to show how your home handles different scenarios, such as hosting family gatherings, cozy nights by the fireplace, or entertaining guests in a decorated dining space.

Staging your home to emphasize these possibilities can help potential buyers imagine themselves living in the space and making their own holiday memories. This emotional connection is a powerful motivator when it comes to making offers.

6. More Attention from Real Estate Professionals

During the peak months, real estate agents and related professionals like photographers, home inspectors, and stagers are often swamped with listings. In contrast, the holiday season typically brings a slower pace. This means that you may receive more focused attention from your agent and have easier access to professionals to help market your home effectively.

Your real estate agent can dedicate more time to marketing strategies, personalized showings, and open houses, ensuring that your property gets the attention it deserves.

7. Online Real Estate Searches Increase During the Holidays

Even during the holidays, prospective buyers continue to search online for their future homes. In fact, online activity often spikes during holiday downtime, as people have more time off work and spend time browsing listings. Ensuring your property has an appealing online presence is crucial to capturing this audience.

With high-quality images, detailed descriptions, and virtual tours, your listing can reach potential buyers during the holiday season when they have more free time to devote to their searches. A well-marketed home that catches the eye during this period can attract more interest than during busier times when people have less time to browse.

8. Neighborhood Appeal During the Holidays

The holiday season is a time when neighborhoods often look their best, adorned with festive lights, decorations, and community events. This added charm can enhance the attractiveness of your home’s location and make the entire area feel more inviting to potential buyers. Buyers can better envision themselves as part of a vibrant community, which can be a significant selling point.

If your neighborhood has a strong sense of holiday spirit, leverage this to your advantage by making your home feel like part of the celebration. Highlight nearby holiday markets, local events, or festive attractions in your listing to emphasize the appeal of the area during this special time.

9. Easier Scheduling for Showings

Holiday schedules, while busy, can sometimes offer more flexibility than the typical workweek. Buyers and sellers alike may have more days off or time available for showings and open houses. This flexibility can make it easier to schedule visits, leading to a higher chance of securing showings that convert into offers.

Real estate agents often report that holiday buyers are less likely to schedule showings for homes they’re only half-interested in. This means that the showings you schedule are more likely to be for serious buyers who are ready to make a decision.

Final Thoughts: Seizing the Opportunity

While selling your home during the holiday season may seem unconventional, it comes with a range of benefits that can make it a profitable and efficient time to list. From motivated buyers and reduced competition to the emotional appeal of a holiday setting, this time of year offers unique advantages.

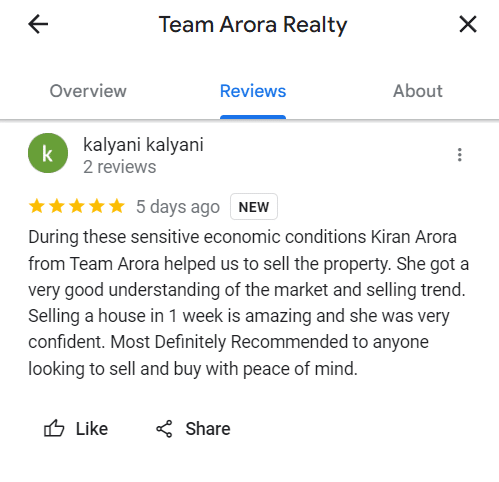

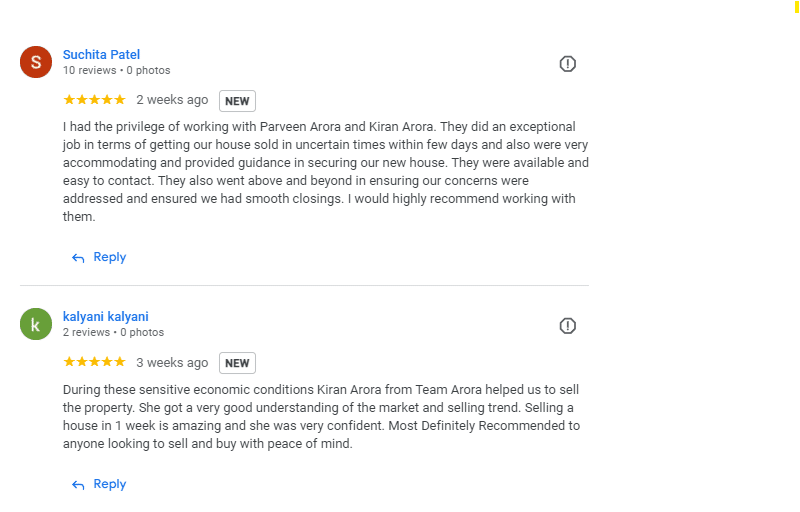

At Team Arora, we understand the importance of timing in real estate. If you’re considering selling your home during the holidays, we’re here to guide you through the process, ensuring that your listing makes the most of these seasonal opportunities. Contact us today for expert advice tailored to your needs, and take advantage of the hidden potential of the holiday real estate market.