In the complex world of finance and economics, few institutions hold as much sway as central banks. In Canada, the Bank of Canada (BoC) plays a pivotal role in shaping the country’s economic landscape, primarily through its power to set interest rates. These rates, in turn, have a profound impact on various aspects of the economy, including the housing market.

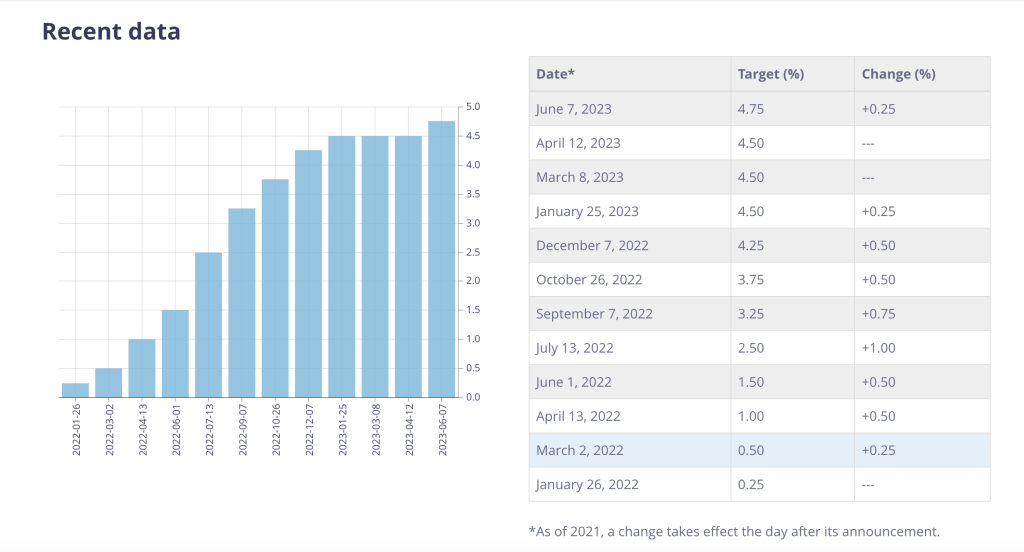

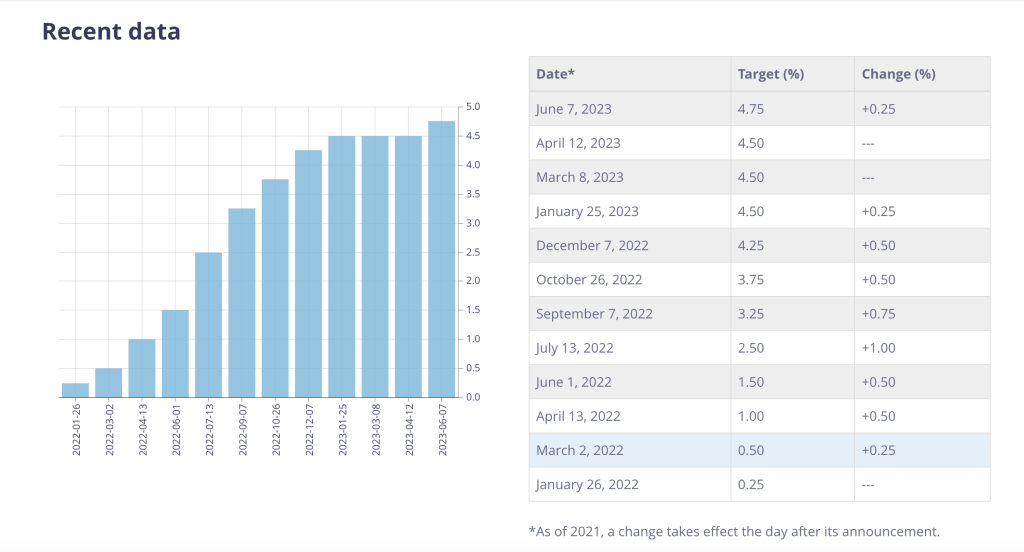

Recently, the BoC has been on a trend of hiking rates, a move that has sent ripples through the financial community and beyond. While rate hikes are typically used as a tool to curb inflation and stabilize the economy, they also bring about significant changes for consumers, particularly those looking to enter the housing market.

This article will delve into the implications of the BoC’s rate hikes, exploring their effects on the housing market, the differing opinions within the finance world regarding future hikes, and the delicate balance the BoC must strike between controlling inflation and avoiding a deep recession. As we navigate these intricate topics, we’ll gain a deeper understanding of the current economic climate and what it could mean for potential homebuyers.

Stay with us as we unpack these complex issues and shed light on the path that lies ahead.

The Impact of Hiking Rates on the Housing Market

Interest rates are a key driver of the housing market, influencing everything from mortgage rates to home prices. When the Bank of Canada hikes rates, it can send shockwaves through the housing sector, affecting both current homeowners and prospective buyers.

At first glance, higher interest rates might seem like bad news for those looking to enter the housing market. After all, higher rates mean higher mortgage costs, which can make homeownership more expensive.

However, the reality is more nuanced. In fact, for those who have not yet taken out a mortgage, these higher rates could actually prove advantageous.

This counterintuitive perspective is rooted in the dynamics of supply and demand. When rates rise, some potential buyers may be deterred from entering the market, leading to a decrease in demand for homes. This can cool down the housing market, potentially leading to lower home prices and less competition among buyers.

For instance, in the context of Toronto’s housing market, bidding wars have been known to drive up the price of a home by $100,000 or more.

However, the psychological impact of rate hikes could deter some buyers, leading to fewer bidding wars and more reasonable prices. In fact, data from Wahi suggests that bidding wars were less widespread in June, when the Bank of Canada last hiked rates, compared to May.

In this sense, higher rates could open the door for some borrowers to save money in the long run. While they may pay a higher rate for their mortgage initially, they could potentially save by avoiding a bidding war and buying a home at a lower price in a cooler market.

However, it’s important to note that this is just one potential outcome. The impact of rate hikes on the housing market can vary widely depending on a range of factors, including the overall state of the economy, the specific local housing market, and the individual circumstances of buyers and sellers. As such, it’s crucial for potential homebuyers to carefully consider their own situation and seek professional advice before making a decision.

The Potential for a Pause in Rate Hikes

While the Bank of Canada’s recent trend of hiking rates has been a significant factor influencing the housing market, it’s important to remember that the future of rate hikes is not set in stone. In fact, there’s a considerable amount of debate within the world of finance about whether another rate hike is imminent.

It would be premature for the Bank of Canada to hike rates again so soon. If the Bank truly believed that another rate hike was the right move, they likely would have increased rates by a larger margin in the previous month.

Another factor to consider is inflation. The Bank of Canada’s target for inflation is 2%, a figure that has not yet been reached. In fact, recent data suggests that inflation has been cooling, with the Consumer Price Index (an indicator of inflation based on changes in the prices of goods and services) showing a decrease from 4.4% in April to 3.4% in May.

Cestnick argues that given the direction inflation is headed, there may not be a need for another rate hike. He suggests that if the goal is to slow down inflation, it’s crucial to avoid causing a nosedive into a deep recession, a risk that could be heightened by aggressive rate hikes.

However, it’s important to note that these are just predictions and opinions. The decision to hike rates lies solely in the hands of the Bank of Canada, and they will base their decision on a wide range of economic indicators and considerations. As such, while we can speculate about the potential for a pause in rate hikes, the future remains uncertain.

The Balance Between Controlling Inflation and Avoiding Recession

Central banks, like the Bank of Canada, have a challenging task: they must maintain a delicate balance between controlling inflation and avoiding a deep recession. This balance is often managed through the manipulation of interest rates, a powerful tool that can influence the pace of economic activity.

Inflation, the general increase in prices and fall in the purchasing value of money, is a natural part of a growing economy. However, when inflation rates rise too quickly, it can erode purchasing power and create economic instability. To slow inflation, central banks can hike interest rates. Higher rates make borrowing more expensive, which can reduce spending and slow down economic activity, thus helping to control inflation.

However, this strategy is not without risks. If interest rates are raised too aggressively, it could significantly decrease spending and investment, potentially leading to a sharp economic downturn or even a recession. This is because higher interest rates increase the cost of borrowing, which can discourage businesses from investing and consumers from spending. If spending and investment decline significantly, it can lead to a decrease in economic output, rising unemployment, and a potential recession.

This is the delicate balancing act that the Bank of Canada must perform. On one hand, they need to raise interest rates to keep inflation in check. On the other hand, they must be careful not to raise rates too quickly or too high, as doing so could risk plunging the economy into a recession.

The recent trend of rate hikes by the Bank of Canada indicates their current focus on controlling inflation. However, voices like Tim Cestnick‘s remind us of the potential risks associated with aggressive rate hikes. As we move forward, the Bank of Canada’s decisions will continue to be a crucial factor shaping Canada’s economic landscape, and the balance they strike will have significant implications for both the housing market and the broader economy.

Looking Ahead: Predictions and Implications

As we look to the future, the Bank of Canada’s decisions on interest rates will continue to be a focal point for economists, investors, and potential homebuyers alike. The next anticipated decision on July 12 will be closely watched, with many eager to see whether the trend of rate hikes will continue or if the Bank will hit pause.

If the Bank of Canada continues to hike rates, it could have far-reaching implications for the housing market and the broader economy. On the housing front, continued rate hikes could further cool the market, potentially leading to lower home prices and less competition among buyers. However, it could also make mortgages more expensive, which could deter some potential buyers.

For the broader economy, continued rate hikes could help keep inflation in check, but they also risk slowing economic growth and potentially leading to a recession if not managed carefully. Businesses may be less likely to invest due to higher borrowing costs, and consumers may cut back on spending, both of which could slow economic activity.

For potential homebuyers, the current economic climate presents both challenges and opportunities. While higher rates could mean more expensive mortgages, they could also lead to a cooler housing market with less competition and potentially lower prices. As such, potential homebuyers should carefully consider their own financial situation and seek professional advice before making a decision.

It’s also important for potential homebuyers to stay informed about economic trends and the Bank of Canada’s decisions. While we can make predictions about the future, the economic landscape is always changing, and staying informed is key to making sound financial decisions.

In conclusion, while the future remains uncertain, one thing is clear: the Bank of Canada’s decisions on interest rates will continue to play a crucial role in shaping Canada’s housing market and broader economy. As we navigate these uncertain times, we’ll be keeping a close eye on the Bank’s decisions and their implications for homebuyers and the economy as a whole.

Conclusion

In this article, we’ve delved into the complex world of interest rates and their profound impact on the housing market and the broader economy. We’ve explored the recent trend of the Bank of Canada hiking rates, a move that has sent ripples through the financial community and beyond.

We’ve examined how these rate hikes can have a cooling effect on the housing market, potentially leading to less competition and lower prices for potential homebuyers. However, we’ve also noted that higher rates mean higher mortgage costs, which can make homeownership more expensive.

We’ve discussed the differing opinions within the finance world regarding the likelihood of future rate hikes, with some experts suggesting that the Bank of Canada might hit pause on its recent trend of rate increases. We’ve also delved into the delicate balance the Bank must strike between controlling inflation and avoiding a deep recession, a task that is managed through careful manipulation of interest rates.

Looking ahead, we’ve considered the potential implications of continued rate hikes, both for the housing market and the broader economy. We’ve noted that while higher rates could cool the housing market and keep inflation in check, they also risk slowing economic growth and potentially leading to a recession if not managed carefully.

In conclusion, the Bank of Canada’s decisions on interest rates play a pivotal role in shaping Canada’s economic landscape. As we navigate these uncertain times, staying informed and seeking professional advice is key. Whether you’re a potential homebuyer, an investor, or simply an interested observer, understanding the implications of these decisions can help you make sound financial decisions and navigate the complex world of economics.

(Source)