The Toronto real estate market has been on a steady rise over the past decade, attracting homebuyers and investors from all over the world. The city’s real estate market has been one of the hottest in Canada, with prices continuing to climb and demand outstripping supply. Several factors account for the growth of the Toronto real estate market, as we will discuss in this blog post.

Population Growth

There has been considerable growth in the population of Toronto, which is a major factor driving the real estate market. The population has grown steadily over the past decade, and with more people living in the city, there is greater demand for housing and higher prices. In conformity with Canadian Statistics, the Greater Toronto Area population will be expected to be more than 2 million by 2041. This rapid population growth has created a strong demand for housing, particularly in the downtown core, where many people want to live and work.

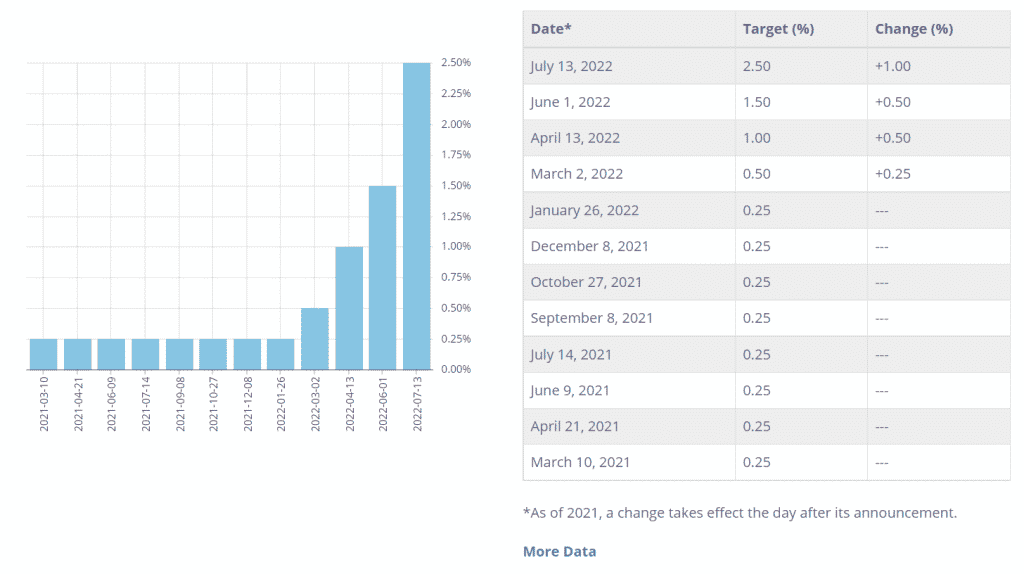

Low-Interest Rates

Another factor contributing to the rise of the Toronto real estate market is low-interest rates. The Bank of Canada has maintained low-interest rates for several years, making it easier for people to qualify for mortgages and afford higher-priced homes. The rise in demand for housing, especially from people who are buying a house for the first time, has increased.

Limited Supply

While the demand for housing in Toronto is high, the supply of homes is limited. Behind this there are many reasons like regulation and low availability of land. In many parts of the city, particularly in the downtown core, there is a limited amount of land available for development. All these things make an impact on the bidding wars, leading to competition in the market, and many offers remain the same.

Foreign Investment

Toronto’s real estate market has attracted a significant amount of foreign investment, particularly from China and the Middle East. These kinds of investments increase the price along with the demand for commercial and housing properties. Many foreign buyers see Toronto as a haven for their money, and they are willing to pay top dollar for properties in the city.

Strong Economy

Toronto has a strong and diverse economy, with a low unemployment rate and a high level of immigration. This has made the city an attractive place to live and invest in real estate. The city’s economic growth has also led to an increase in high-paying jobs, which has driven up demand for housing in the city.

In addition to these factors, there are several other reasons why the Toronto real estate market has been on the rise. For instance, the area has a high quality of life, which includes top-class restaurants and excellent culture. It is also a safe city with low crime rates, making it an attractive place to live for families and young professionals.

While the rise of the Toronto real estate market has been a boon for home sellers and investors, it has also created some challenges for homebuyers. In the expensive lifestyle of the city, only some people can afford a home to buy. This has led to an increase in rental demand, which has driven up rental prices in the city. Many renters are struggling to find affordable housing, particularly in the downtown core.

Housing Bubble

The rise of the Toronto real estate market has also led to concerns about a potential housing bubble. Some experts have warned that the market may be overvalued and that a correction may be on the horizon. While it is impossible to predict the future of the real estate market with certainty, home buyers and investors need to be aware of the risks associated with investing in a rapidly rising market.

In conclusion, the Toronto real estate market has been on a steady rise in recent years, driven by population growth, low-interest rates, limited supply, foreign investment, and a strong economy. While this trend may continue in the short term, it is important for home buyers and investors to approach the market with caution and to be aware of the risks associated with investing in a rapidly rising market.

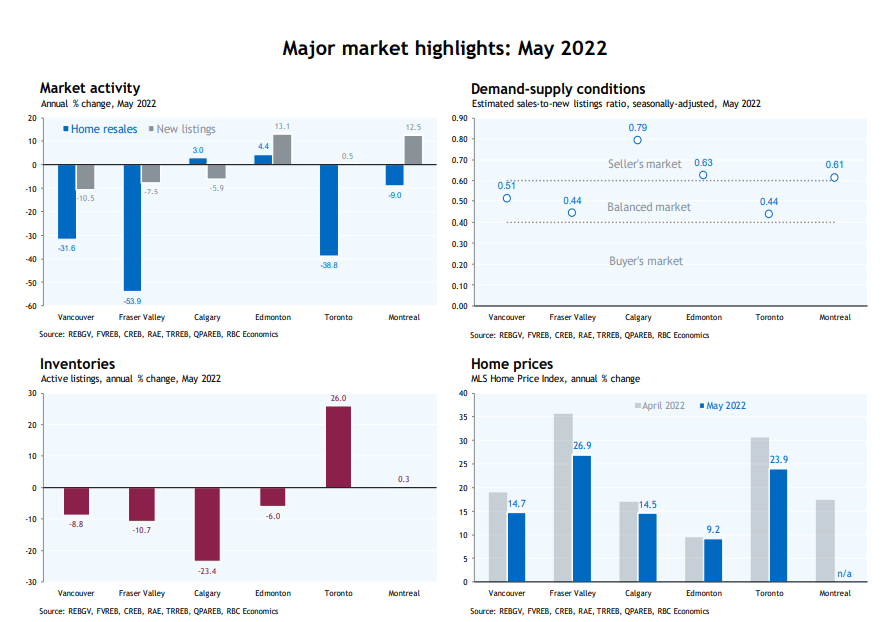

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

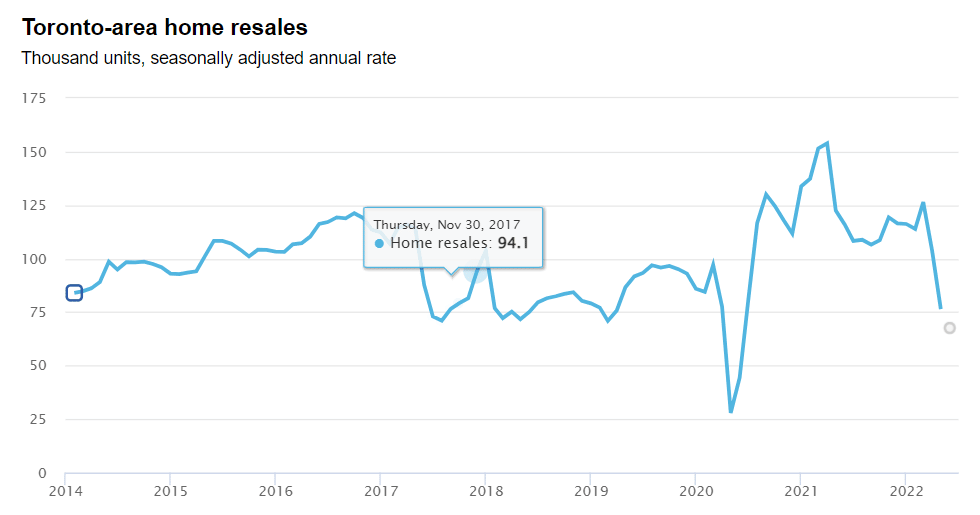

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022