The decision to sell the family home is never an easy one. It often involves emotional, financial, and practical considerations. Whether due to downsizing, relocation, or the passing of a loved one, an estate sale can be an effective way to liquidate assets and ensure that valuable items find new homes. In this comprehensive blog post, we will explore the intricacies of estate sales, focusing on the Greater Toronto Area (GTA) housing market trends, and provide insights on when and how to conduct an estate sale successfully.

Understanding Estate Sales

What is an Estate Sale?

An estate sale is a type of sale conducted to dispose of a significant portion of a person’s or family’s belongings. This typically happens after major life events such as the death of a family member, divorce, or a move to a new location. Estate sales are usually managed by professionals who specialize in appraising, organizing, and selling items ranging from household goods to high-value collectibles.

Why Conduct an Estate Sale?

There are several reasons why someone might opt for an estate sale:

- Financial Efficiency: Estate sales can generate significant revenue by selling valuable items that might otherwise go unused.

- Downsizing: For those moving to a smaller home, an estate sale is an effective way to reduce belongings.

- Liquidation After Death: When settling an estate after a loved one’s passing, an estate sale can help distribute assets equitably among heirs.

Estate Sales in Toronto and Ontario

Market Trends

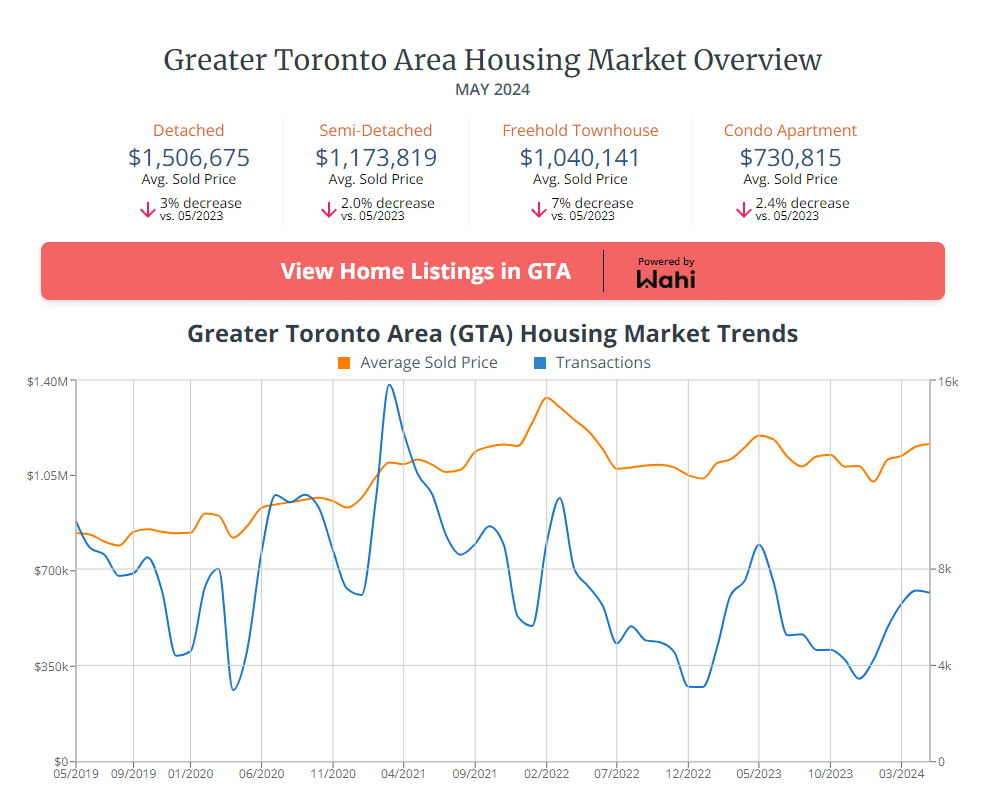

The Greater Toronto Area (GTA) housing market has seen notable fluctuations over the past few years. According to recent data from May 2024, the average sold prices for different types of properties are as follows:

- Detached Homes: $1,506,675 (3% decrease from May 2023)

- Semi-Detached Homes: $1,173,819 (2% decrease from May 2023)

- Freehold Townhouses: $1,040,141 (7% decrease from May 2023)

- Condo Apartments: $730,815 (2.4% decrease from May 2023)

These statistics indicate a slight cooling in the market, which could affect the timing and strategy for estate sales. For those looking to sell high-value items such as antiques and collectibles, understanding these trends is crucial for maximizing returns.

Data from June 2024

- Estate Sales in Toronto:

- Total estate sales conducted: 45

- Average value of items sold per sale: $25,000

- Most common items sold: Furniture, antiques, jewelry, art

- Average duration of sales: 3 days

- Estate Sales in Ontario:

- Total estate sales conducted: 220

- Average value of items sold per sale: $20,000

- Most common items sold: Household goods, collectibles, vintage items

- Average duration of sales: 2.5 days

When to Consider an Estate Sale

Assessing the Need

Before deciding on an estate sale, it’s important to assess whether it’s the right time. Consider the following scenarios:

- Relocation or Downsizing: Moving to a smaller home or relocating to a new city can necessitate the sale of excess belongings.

- Financial Necessity: When facing financial difficulties, liquidating assets through an estate sale can provide much-needed funds.

- After a Loved One’s Passing: Settling an estate often involves distributing or liquidating assets, making an estate sale an effective solution.

Preparing for the Sale

Hiring Professionals

One of the first steps in preparing for an estate sale is hiring a professional estate sale company. These experts can handle everything from appraising and pricing items to organizing and marketing the sale. They ensure that the process is smooth and that items are sold for their fair market value.

Organizing and Appraising

Professional organizers will:

- Inventory Items: Create a comprehensive list of items to be sold.

- Appraise Items: Determine the value of each item, ensuring that high-value items are priced appropriately.

- Set Up the Sale: Organize items in an appealing manner to attract buyers.

Marketing the Sale

Effective marketing is crucial for a successful estate sale. Professional estate sale companies will:

- Advertise Locally and Online: Use various platforms to reach potential buyers, including social media, estate sale websites, and local classifieds.

- Highlight High-Value Items: Emphasize unique and valuable items to attract serious buyers and collectors.

Conducting the Sale

Managing the Event

During the sale, professionals will manage all aspects of the event, including:

- Customer Service: Assisting buyers with questions and facilitating transactions.

- Security: Ensuring the safety of items and managing crowd control.

- Negotiations: Handling price negotiations to maximize returns.

Post-Sale Activities

After the sale, the estate sale company will:

- Clear Out Remaining Items: Arrange for the donation or disposal of unsold items.

- Final Settlement: Provide a detailed account of the sale and disburse proceeds to the family or estate.

An estate sale is a practical and efficient way to liquidate assets, whether due to relocation, downsizing, or settling an estate. By understanding the nuances of estate sales and staying informed about market trends in Toronto and Ontario, families can make informed decisions to maximize the benefits of their sale. Engaging professional estate sale services ensures a smooth process and optimal results, providing peace of mind during what can often be a challenging time.

Recommendations

For those considering an estate sale, here are a few tips:

- Start Early: Give yourself plenty of time to organize and prepare for the sale.

- Hire Professionals: Engage experienced estate sale companies to handle the details.

- Stay Informed: Keep abreast of market trends to time your sale for the best results.

By following these steps, you can navigate the complexities of an estate sale with confidence and ensure that you achieve the best possible outcome for your family’s assets.