Are you considering buying a house, selling your current one, or just looking to give your residence some much needed upgrades? If so, there are certain renovations you can make that will help improve the value of your property. From renovating kitchens and bathrooms to updating landscaping and outdoor living spaces; investing in the right home renovation projects can pay off when it comes time to sell or refinance. In this blog post we’ll explore simple ways to maximize returns on investments with short-term renovations that add long-term benefit – all while making your house beautiful!

Investing in Quality Materials – How to Choose the Right Ones for Your Renovations

When it comes to home renovations, investing in quality materials is essential if you want to achieve a finished product that looks and functions as it should. But with so many options out there, it can be overwhelming to figure out what to choose. One key factor to consider is the durability and longevity of the material, as well as its overall aesthetic appeal. For example, if you’re renovating a kitchen, you might want to opt for granite countertops or stainless steel appliances that will withstand the wear and tear of everyday use. On the other hand, if you’re redoing your bathroom, you might want to choose tile or stone that can hold up to moisture and humidity. Ultimately, the right choice will depend on your personal style and functional needs, as well as your budget. So take some time to explore your options and don’t be afraid to ask for advice from professionals in the industry. Investing in quality materials will pay off in the long run, both in terms of your enjoyment of your space and the potential value it could add to your home.

Making Minor Updates That Make a Big Difference

Sometimes, it doesn’t take major overhauls to boost the appeal of your website, social media page, or any other digital platform. A few minor updates can make a significant difference to your audience’s experience. How about changing the font, incorporating more high-quality images, or adding a few easy-to-operate navigation links? These small updates may seem insignificant, but they can make your platform look more polished and professional while boosting user engagement. Plus, you won’t need to spend lots of time or money making these minor updates. So, why not try some minor updates and watch as they make a big difference in your digital presence?

Maximizing Your Curb Appeal with Landscaping and Outdoor Lighting

When you’re looking to spruce up your home, one of the first things you might consider is the outside of your house. To make sure you’re getting the most out of your property, consider adding some landscaping and outdoor lighting. A well-thought-out approach to these elements can help maximize your curb appeal, making your home more inviting and attractive to potential buyers or visitors. Not only will this increase the perceived value of your property, but it can also make your home more enjoyable for you and your family. From planting flowers and bushes to adding spotlights and path lights, there are plenty of ways to transform your exterior space. So if you’re ready to take your home to the next level, start exploring some landscaping and lighting ideas today.

Upgrading Your Windows and Doors for Improved Efficiency

Upgrading your windows and doors might not be the most buzzworthy home improvement project, but it can have a significant impact on your energy bills. In fact, windows and doors can account for up to 30% of your home’s energy loss! By upgrading to energy-efficient windows and doors, you can improve your home’s insulation, which means keeping the warm air in during the winter and the cool air in during the summer. That translates to lower energy bills and a more comfortable home. Plus, with modern upgrades, you don’t have to sacrifice style for efficiency. You can choose from a variety of materials, colours and finishes to match your home’s aesthetic. So, whether you’re looking to save money or make your home more comfortable, upgrading your windows and doors is a smart move.

Installing New Flooring to Increase Home Value

If you’re looking for a way to increase your home’s value, consider installing new flooring! Not only can it completely transform the look of a room, but updated flooring can also make your home more appealing to potential buyers. There are plenty of flooring options to choose from, each with their own benefits and drawbacks. For a classic and timeless look, hardwood floors are always a great option. If you’re looking for something more durable and easy to maintain, consider going with tile or vinyl flooring. Whatever you choose, make sure to hire a professional to ensure the job is done right. With new flooring, you’ll be able to increase your home’s value and enjoy your updated space.

Prioritizing Kitchen and Bathroom Renovations for Maximum Impact

When it comes to renovating your home, the kitchen and bathroom are the two areas that can have the most impact on both the functionality and aesthetic appeal. However, prioritizing which one to renovate first can be a bit tricky. If you’re looking for a more functional upgrade, start with the kitchen. This area is often the hub of the home and is where meals are prepared and families gather, so investing in high-quality appliances, adequate storage, and durable surfaces can make a huge difference. On the other hand, if you’re looking to make a statement and add value to your home, a bathroom renovation can be the way to go. Upgrading your fixtures, adding updated tile or stone, and investing in a luxurious bathtub or shower can completely transform the space into a spa-like oasis. Ultimately, the decision of which to prioritize first comes down to your personal preferences and needs. Regardless of which room you start with, a well-planned renovation can add both functionality and value to your home.

With the right combination of quality materials, minor updates, and efficient upgrades, you can significantly benefit from increasing your property’s value through home renovations. Investing in the right materials is not easily done alone, so it’s important to research reviews, ask industry professionals, and be sure that whatever products you decide to include are usually built to last. This not only saves you money in the long run as repairs and replacements won’t be necessary for some years, but also helps improve your property value even further. At the same time, making a few minor changes here and there can also go a long way in improving your value without breaking the bank — such as adding landscaping and outdoor lighting for improved curb appeal or new flooring for easy updates. Ultimately though, if maximum impact from increasing property value is what you pursue then it is wise to prioritize kitchen and bathroom renovations as these projects tend to draw more attention. Nevertheless, bear in mind that whatever approach or project you decide on should align with both short-term desires and long-term goals!

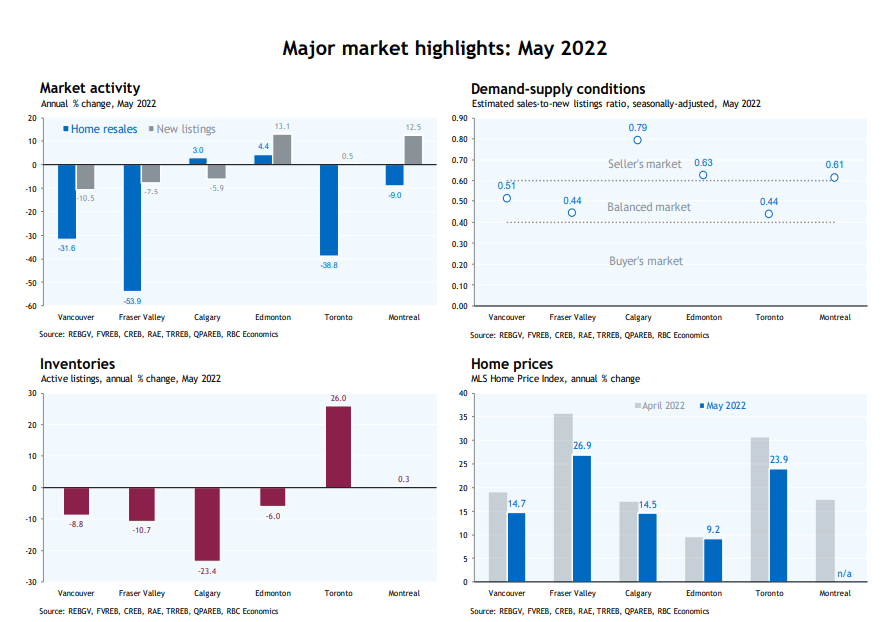

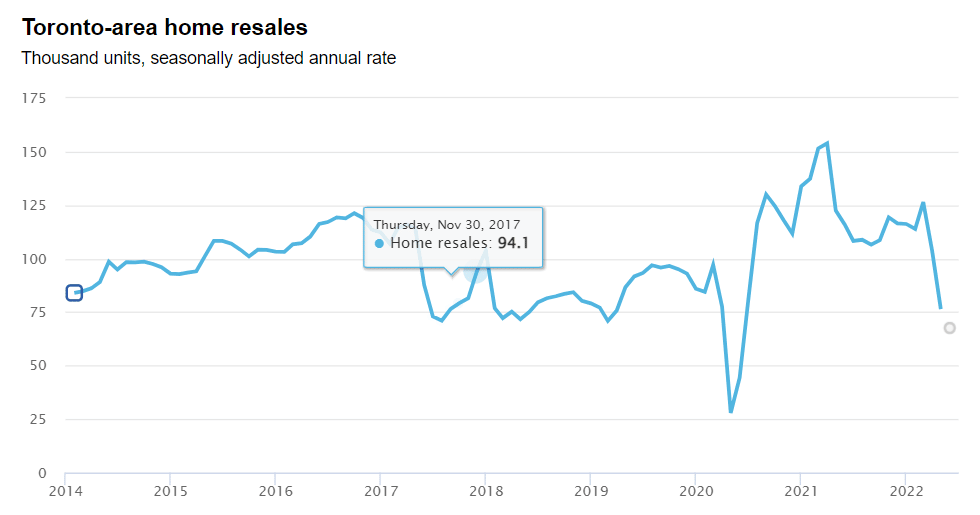

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022