Originally published on January 5, 2024, by Marcus Lu, with graphics and design by Miranda Smith*

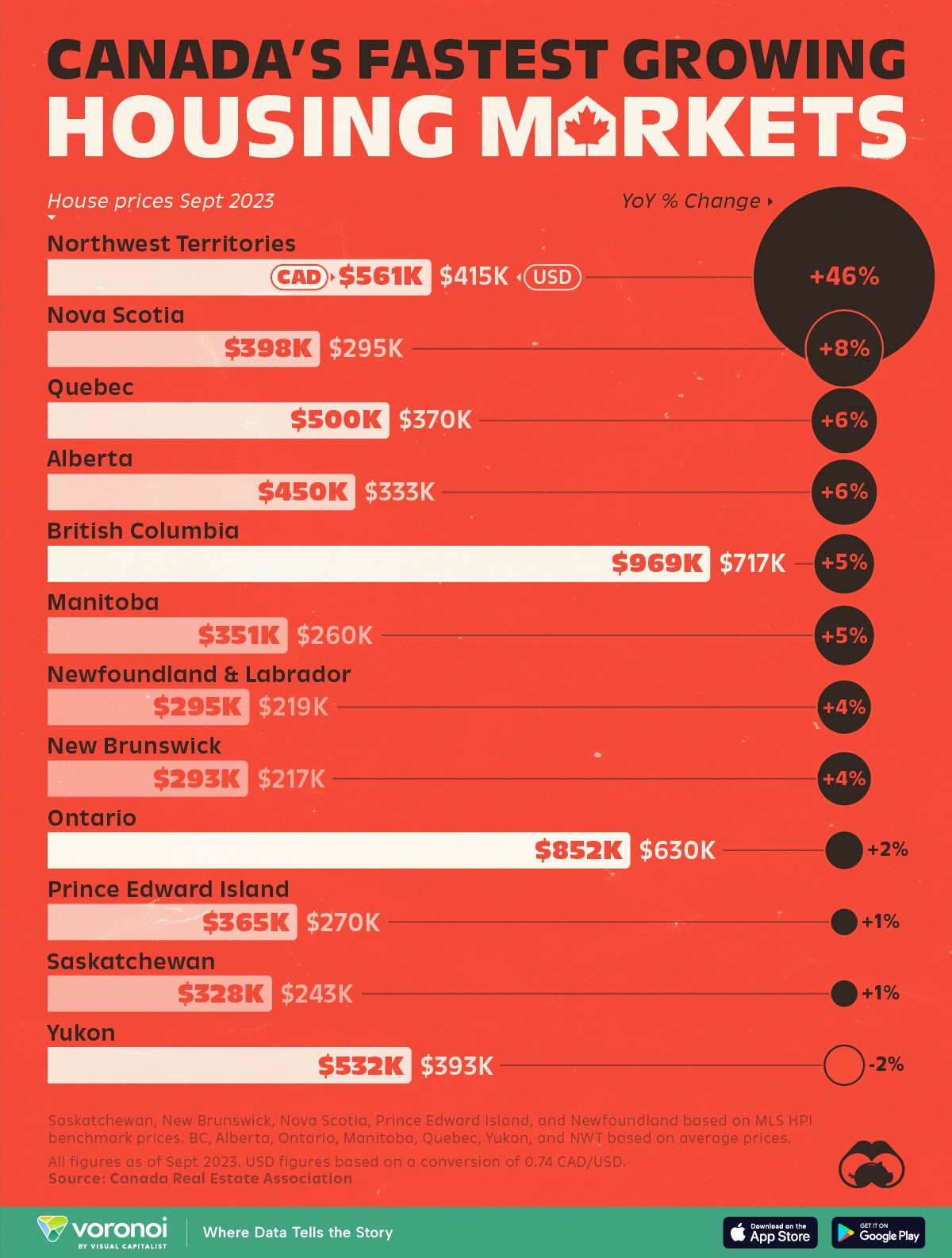

In a recent detailed analysis, the Canadian real estate landscape of 2023 has been meticulously charted, showcasing the fluctuating housing market across various provinces and territories. This comprehensive report, initially featured on the Voronoi app, presents a dynamic bar chart representation of the housing markets in Canada, focusing on the percentage growth in prices from September 2022 to September 2023.

A Decade of Surge: Canadian Housing Prices Over the span from 2010 to 2022, the Canadian housing market witnessed a staggering 90% increase in real estate prices. This surge positioned Canada as one of the global leaders in expensive and less affordable housing sectors.

2023: A Close-Up View The article offers an in-depth look at the average housing prices across Canada’s provinces and territories for the year 2023, with the exception of Nunavut. The data, sourced from the Canada Real Estate Association (CREA), combines average figures from provincial entities and benchmark statistics derived from CREA’s MLS® HPI tool.

Understanding Benchmark Homes The concept of a “benchmark home” is crucial in this context. It refers to a property that embodies the typical characteristics of homes in its area, thereby providing a more accurate reflection of prices by accounting for often overlooked features like living area size and the presence of unfinished basements.

Price Dynamics: A Provincial Breakdown The report ranks the provinces and territories based on their year-over-year price growth, highlighting significant trends. For instance, the Northwest Territories saw an exceptional 40% increase in average house prices, reaching over half a million dollars in September 2023. This contrasted with the national average of $640,000.

The Standout Performers While the Northwest Territories led with a 46% increase, other regions like Nova Scotia, Quebec, and Alberta also showed notable growth. Conversely, the Yukon experienced a slight decline.

Emerging Patterns and Predictions The rapid price increase in the Northwest Territories, attributed to limited supply and heightened wildfire risks, was a unique phenomenon. However, every other region, except the Yukon, experienced some level of growth. British Columbia and Ontario, the priciest regions, might see a dip in prices in 2024, despite a surge in housing supply.

This analysis offers a vital perspective for real estate professionals and investors, highlighting the diverse and ever-changing landscape of Canada’s housing market in 2023.

For more detailed insights and data, the original article can be accessed on the Voronoi app or through its original publication by Marcus Lu, featuring graphics and design by Miranda Smith.